Key takeaways:

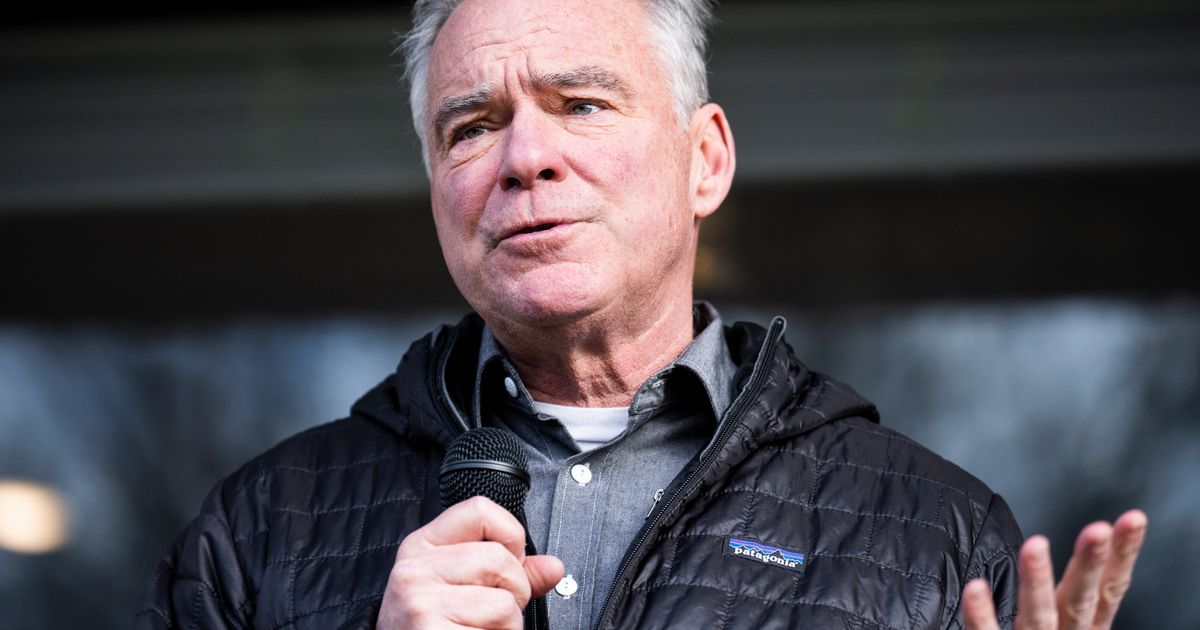

- The 2018 decision to roll back Dodd-Frank protections was supported by 17 Senate Democrats, including Sen. Tim Kaine (D-Va.).

- Critics of the legislation have argued that it has allowed banks to take on more risk in order to boost their profits, which could lead to more collapses and financial crises.

- The collapse of the two key banks has caused many to question the wisdom of the 2018 decision to roll back Dodd-Frank protections.

Last week, two key banks collapsed, setting off fears of another costly financial crisis. This collapse has caused many to reflect on a 2018 decision by Congress to roll back critical Dodd-Frank protections, which eased regulations on mid-sized banks by raising the “too big to fail” threshold from $50 billion in assets to $250 billion.

The legislation, which was passed on a bipartisan basis by the Republican-led Congress, was supported by 17 Senate Democrats, including Sen. Tim Kaine (D-Va.). Kaine defended his vote, saying that his community banks “really needed it.”

Critics of the legislation have argued that it has allowed banks to take on more risk in order to boost their profits, which could lead to more collapses and financial crises. They have also argued that the legislation has weakened the ability of regulators to protect consumers from predatory lending practices.

The collapse of the two key banks has caused many to question the wisdom of the 2018 decision to roll back Dodd-Frank protections. While some have argued that it was necessary to provide relief to community banks, others have argued that it has weakened the ability of regulators to protect consumers and has allowed banks to take on too much risk.

The debate over the 2018 decision to roll back Dodd-Frank protections is likely to continue in the coming weeks and months. As the economic fallout from the collapse of the two key banks becomes clearer, it will be important to consider the potential implications of the legislation and to ensure that any future decisions are made with the best interests of consumers in mind.

Be First to Comment