Key takeaways:

- Hunter Biden has been indicted on nine federal tax-related charges, including three felony counts.

- The charges allege that Hunter Biden failed to pay taxes, failed to file, evaded an assessment and filed a fraudulent form.

- If convicted, Hunter Biden could face up to five years in prison for each of the three felony counts and a maximum of one year in prison for each of the six misdemeanor counts.

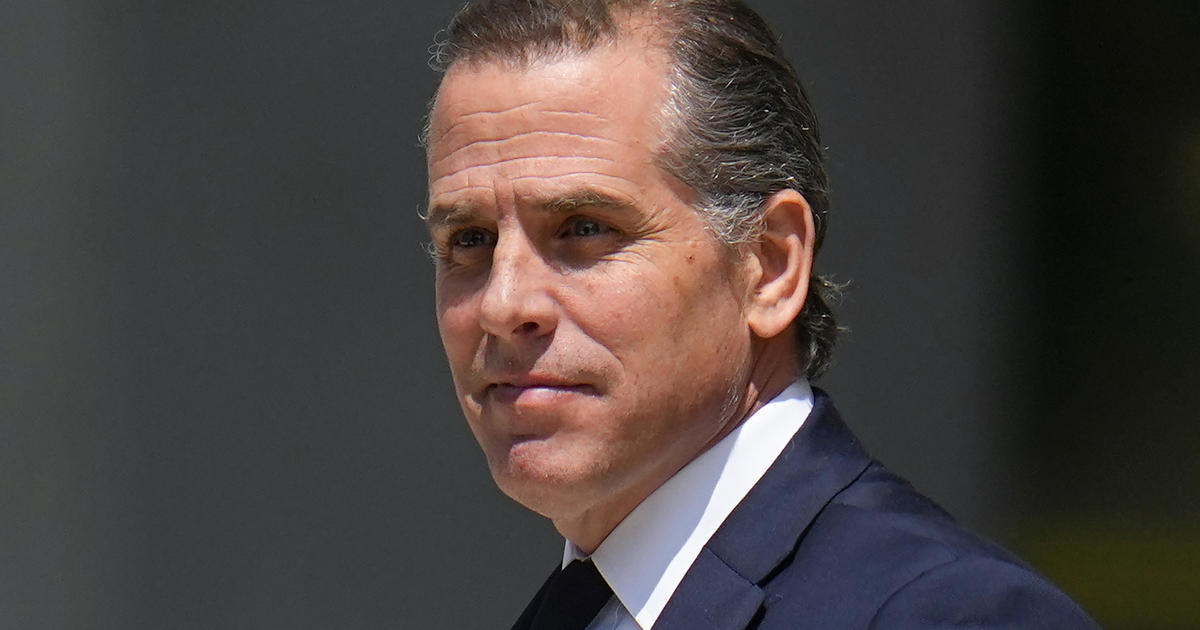

Hunter Biden, son of President Joe Biden, has been indicted on nine federal tax-related charges, including three felony counts, according to court documents filed Thursday in a federal court in Los Angeles.

The 56-page court filing laid out a series of charges, including allegations that Hunter Biden failed to pay taxes, failed to file, evaded an assessment and filed a fraudulent form. Federal prosecutors allege in the indictment that Hunter Biden engaged in “a four-year scheme to not pay at least $1.4 million” in federal income taxes for the years 2016 through 2019.

The indictment makes references to a range of business relationships that brought Hunter Biden income that the government alleges provided him sufficient means to pay taxes. It further alleges that “rather than pay his taxes, the Defendant spent millions of dollars on an extravagant lifestyle.”

The indictment charges Hunter Biden with failure to file and pay taxes, evasion of assessment and filing a false or fraudulent tax return. If convicted, Hunter Biden could face up to five years in prison for each of the three felony counts and a maximum of one year in prison for each of the six misdemeanor counts.

The case is being prosecuted by the U.S. Attorney’s Office for the Central District of California. Hunter Biden is expected to appear in court in the near future. It is unclear at this time if he will enter a plea or if the case will go to trial.

Be First to Comment