Key takeaways:

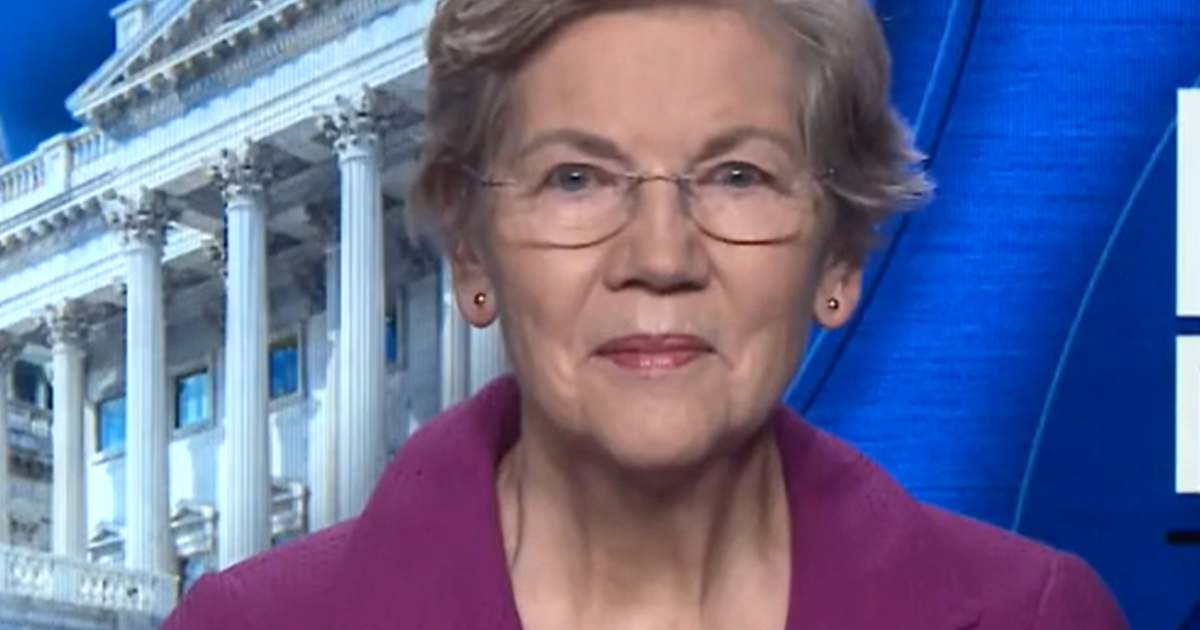

- Sen. Elizabeth Warren has called for stricter banking regulations in the wake of the collapse of two banks earlier this month.

- Warren has suggested lifting the Federal Deposit Insurance Corporation’s (FDIC) insurance cap from its current $250,000 limit.

- Warren has criticized Federal Reserve Chair Jerome Powell for “failing at both” in his duties.

Sen. Elizabeth Warren, D-Mass., has called for stricter banking regulations in the wake of the collapse of two banks earlier this month. In an interview with “Face the Nation” Sunday, Warren said that lifting the Federal Deposit Insurance Corporation’s (FDIC) insurance cap from its current $250,000 limit is an option that “has got to be on the table right now.”

“I think the lifting the FDIC insurance cap is a good move,” Warren said. “I’ve said it to everyone. Now the question is where’s the right number on lifting?”

Warren also criticized Federal Reserve Chair Jerome Powell, who was first nominated by then-President Donald Trump in 2017. She said that Powell has “failed at both” in his duties and shouldn’t be in his role.

“He has failed at both,” she said. “I have said it as publicly as I know how to say it.”

Warren’s comments come as lawmakers debate how to respond to the rapid collapse of two banks earlier this month. Warren argued that lifting the FDIC insurance cap would require regulators to do their jobs and would help protect consumers from banks that are under-regulated.

Be First to Comment