Key takeaways:

- The Federal Deposit Insurance Corporation (FDIC) is responsible for insuring deposits up to $250,000.

- Treasury Secretary Janet Yellen said the federal government would not bail out Silicon Valley Bank, but is working to help depositors.

- The FDIC is currently working to protect the interests of depositors, and the Treasury Department is monitoring the situation closely.

The Federal Deposit Insurance Corporation (FDIC) is responsible for insuring deposits up to $250,000, but many of the customers of Silicon Valley Bank had more than that amount in their accounts. On Sunday, Treasury Secretary Janet Yellen said that the federal government would not bail out Silicon Valley Bank, but is working to help depositors who are concerned about their money. Yellen emphasized that the situation was much different from the financial crisis almost 15 years ago, which led to bank bailouts to protect the industry.

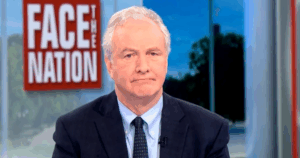

In an interview with CBS’ “Face the Nation,” Yellen provided few details on the government’s next steps. Rep. Ro Khanna, Democrat of California, who represents the California District where Silicon Valley Bank was once headquartered, was also interviewed on the show. Khanna expressed his concern about the lack of clarity and strength in the Treasury’s remarks, and the fear that some workers across the country won’t receive their paychecks.

Yellen stated that the principle needs to be that all depositors will be protected and have full access to their accounts Monday morning. However, she did not provide further details on how the government plans to do this. Khanna said he has been in contact with the White House, Treasury, and FDIC to ensure that the government is taking the necessary steps to protect depositors.

The FDIC is currently working to protect the interests of depositors, and the Treasury Department is monitoring the situation closely. It is unclear how the government will help those affected by the Silicon Valley Bank closure, but the FDIC is working to ensure that all depositors will have access to their accounts.

Be First to Comment