Key takeaways:

- The study found that nearly 60% of banks’ branches with hidden fees are located in counties with a poverty rate higher than the national average.

- President Joe Biden and Consumer Financial Protection Bureau director Rohit Chopra recently announced steps to limit credit card late fees.

- The study highlights the need for greater regulation of these fees, and the importance of ensuring that these fees are not disproportionately impacting low-income communities.

A new study has revealed that the banks that rely on hidden fees, also known as “junk fees”, are primarily located in low-income parts of the United States. The fees, which are now attached to a variety of products and services, such as credit cards, concert tickets, and airline tickets, have been estimated to cost consumers at least $29 billion each year.

The study, conducted by the US, looked at the 20 banks in the US that generate the largest share of their income from service charges. It found that nearly 60% of their branches are located in counties with a poverty rate higher than the national average, and 72% of their branches are in counties with a median income lower than the national average.

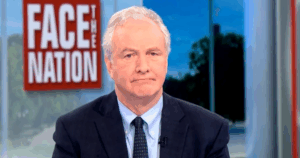

In response to this, President Joe Biden and Consumer Financial Protection Bureau director Rohit Chopra recently announced steps to limit credit card late fees. This was further emphasized in President Biden’s State of the Union address on Tuesday evening, where he vowed to ban the “junk fees” that affect almost every American.

The study highlights the need for greater regulation of these fees, and the importance of ensuring that these fees are not disproportionately impacting low-income communities. It is hoped that the steps taken by the Biden administration will help to reduce the burden of these fees on consumers, and ensure that they are not taken advantage of.

Be First to Comment